How to Make IRS Payments from Overseas: A Complete Guide

Table of Contents

1. Setting Up Your Overseaspayments Account

2. Converting Your Currency to U.S. Dollars

3. Adding the IRS as a Payment Recipient

4. Completing Your IRS Payment

5. Confirming Payment with the IRS

6. Handling IRS Tax Refunds from Abroad

7. Tips to Avoid Common Errors

Paying U.S. taxes from abroad can feel complicated, especially if you are unfamiliar with IRS procedures or international banking regulations. Many taxpayers face issues like delayed payments, rejected transfers, or misapplied funds, which can lead to unexpected interest or penalties. These challenges usually occur when banks cannot verify IRS account information, or when payment references are entered incorrectly. A single misplaced number can mean your funds are delayed or applied to the wrong tax period. At Overseaspayments.com, we specialise in helping clients navigate these complexities. With our secure platform and experienced support team, international taxpayers, businesses, estates, and trusts can make IRS payments efficiently, reduce the risk of errors, and save money through competitive foreign exchange rates.

1. Setting Up Your Overseaspayments Account

Creating an account with Overseaspayments.com is the first step toward making hassle-free IRS payments from abroad. The registration process is quick and straightforward, providing instant access to a secure online platform designed specifically for international transfers and currency management. You can register as an individual, business, estate, or trust, and once your account is verified, you will gain the ability to send funds, manage multiple currencies, and track payments with ease. Proper account setup is essential because unverified accounts or incomplete details can delay transactions, especially when dealing with the IRS. By using our platform, you also benefit from enhanced security features, ensuring that your sensitive tax and banking information is protected at all times.

2. Converting Your Currency to U.S. Dollars

International banks often struggle with foreign tax payments, which can result in high fees or delayed transfers. Our platform allows you to convert your local currency into U.S. dollars (USD) efficiently, giving you more control over costs and timing. You can either pre-fund your account in your home currency or purchase USD in advance, locking in a favorable exchange rate. This protects you from sudden fluctuations in the currency markets and helps you budget accurately for your IRS payments. Additionally, our team can provide guidance on the optimal timing for currency conversion and explain the potential tax implications of foreign exchange. By taking these steps, you can ensure the funds are ready to be sent on time, avoid unnecessary delays, and reduce the risk of extra costs associated with rushed transfers.

3. Adding the IRS as a Payment Recipient

Before making any IRS payment, it is crucial to add the IRS as a payment recipient in your account. Accurate entry of recipient details ensures that your funds are correctly applied and that your payment is not delayed or rejected. Typically, this includes the IRS account name, the taxpayer identification number, the routing number, and the IRS payment address. Many international clients make mistakes at this stage by entering incomplete or incorrect information, leading to returned payments or misapplied funds. Our platform simplifies this process by guiding you step by step, and our team is available to verify that the information is correct. This extra level of assurance helps ensure your payment reaches the IRS efficiently and is allocated correctly to your tax account.

4. Completing Your IRS Payment

Once your account is funded and the IRS is added as a recipient, you can complete your payment. One of the most critical aspects of international IRS payments is the payment reference, which allows the IRS to identify which taxpayer and tax period the funds relate to. A reference typically includes the taxpayer ID, a short form of your name, the tax year, tax type, and the applicable month or quarter. Omitting or misordering any of these details can result in delays or penalties. By using our platform, you can enter the information correctly and double-check it before submission. This step not only ensures the payment is credited to the right account but also provides peace of mind, especially for clients who have experienced errors with international transfers in the past.

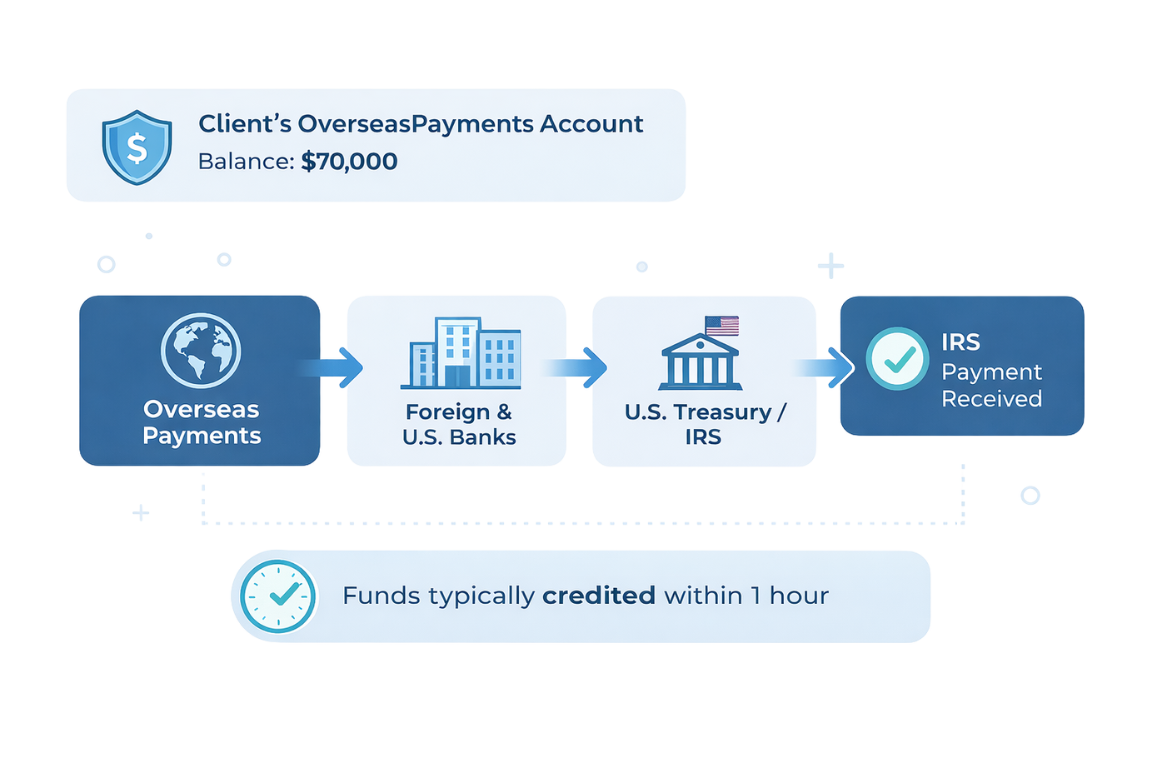

5. Confirming Payment with the IRS

After your payment is sent, funds typically reach the IRS quickly, sometimes within an hour. Our platform provides real-time tracking and payment confirmation, so you know exactly when the transfer has been completed. Additionally, we offer optional support for contacting the IRS to verify that your payment has been allocated correctly. This is particularly valuable for larger payments or for clients handling multiple tax accounts. Confirming payment reduces the risk of misapplied funds and ensures that you can continue with other financial planning or tax obligations without unnecessary delays.

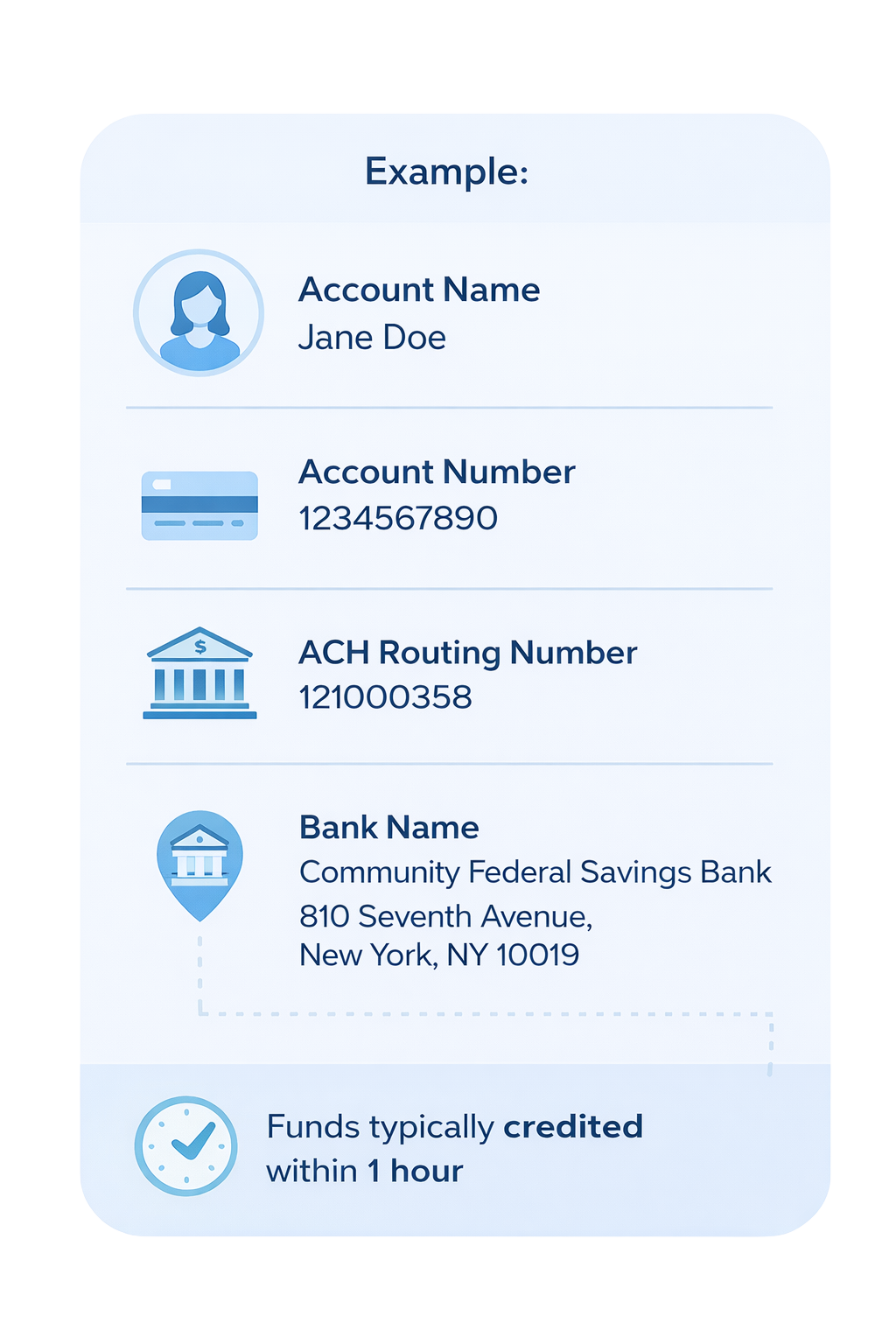

6. Handling IRS Tax Refunds from Abroad

Receiving a tax refund from the IRS can be a challenge if you do not have a U.S. bank account. Without one, refunds are typically issued as physical checks, which can be expensive or slow to deposit internationally. Many banks charge high fees or may not accept foreign IRS checks at all. OverseasPayments.com provides a convenient solution by offering named U.S.-based USD accounts for receiving refunds electronically. This avoids the delays and costs associated with checks, allows you to convert your funds to your preferred currency at competitive rates, and gives you complete control over timing. Simply provide these account details to your tax advisor when filing your return, and the funds will be credited directly to your account once the refund is processed.

7. Tips to Avoid Common Errors

Paying the IRS from overseas is straightforward when done carefully. To reduce the risk of mistakes, make sure to:

Double-check all IRS account details and payment references before sending funds

Ensure your USD balance covers the payment amount plus any transaction fees

Avoid last-minute transfers close to IRS deadlines to prevent delays

Keep copies of all confirmation emails and payment receipts for your records

Contact your tax advisor if you are unsure about reference formatting or account details

Following these best practices ensures your payments and refunds are processed quickly, accurately, and efficiently.

Conclusion

Making IRS payments from abroad doesn’t have to be stressful. By using OverseasPayments.com, you gain access to a secure platform, competitive currency exchange rates, and expert support to handle every step of the process, from setting up an account and sending payments to receiving refunds. With careful planning and the right guidance, you can simplify international tax obligations and have confidence that your funds are applied correctly and on time.

Thank You!

We've received your enquiry. A member of our team will be in touch shortly.